Oil prices fluctuate in the $50 range as geopolitical events fail to disrupt crude supplies.

STEVE AUSTIN | 2017/04/18

Well, only three months into the year and so far 3 of our 9 initial predictions for 2017 have already unraveled and the rest are in the process of doing so.

- keystone pipeline is happening

- oil prices remain in the $50 range

- major new pipelines are being built to corner the European energy market

Oil prices gyrate

Yes, oil prices are yo-yoings and how. From trading above $100 a barrel in May 2014, the oil prices tumbled below $30 in January 2016. At present, the price hovers around the $50-55 mark mainly due to temporary geo-political factors- Hello, Syria and Libya.

On March 08, WTI oil price dropped over 5.4% to $50.28 a barrel in one trading session. The decline continued and WTI oil price remained below $50 for several weeks. West Texas Intermediate futures (for May) fell by 16 cents, whereas Brent Crude lost 15 cents in London to lag at $50.49 a barrel. For both the benchmarks, the oil prices witnessed their lowest since Nov. 30. If you remember, that was when OPEC decided to cut production output, resulting in prices hurling down like a pack of cards. By the dawn of April 10, the WTI price crept to $53 and Brent rose to $55.98 on the back of Syrian tension and shutdown of a Libyan oil field.

Aside from these perceived geopolitical volatility, longer term trend still points to lower oil prices: the supply mechanism remains strong and so are the crude inventories. Although crude inventories play a large role, there are other prevalent factors which will keep oil prices from rising, namely:

- US oil rig count rose 21 to 789 in 1 week and rose by 313 in a year or 65%.

- OPEC’s threat to cut production is being dismissed by financial markets.

- Financial markets acknowledge Trump is making due on his promises to increase production and ensure energy security.

Record US strategic petroleum reserve

Chances are you may have heard of SPR or Strategic Petroleum Reserves. So, what is this SPR? In simple terms, it’s emergency stockpile of crude oil in the US. You know, something to fall back on during sudden crisis like supply crunch or enemy attack. For good measure, the US has the largest stockpile of oil in the world. The reserve consists of a staggering capacity of 727 million barrels stored in huge underground salt caverns in Texas and Louisiana. Federally owned, the crude inventories hold mostly sour crude with high sulfur content which can be processed by the refineries in the US.

And we have to thank Gulf nations for SPR. Going back to the 1973 oil crisis, the Arab nations conspired to place an oil embargo which froze out oil entering the US and Europe, destabilizing Western economies. As a result, Uncle Sam created the SPR to counter any such moves in the future. SPR is like an insurance policy. When hurricane Katrina ravaged the Gulf of Mexico in 2005 affecting the domestic oil production, there was SPR to fall back on. The same happened in 1991 during Operation Desert Storm. If, for some reason, the price of oil skyrockets, the SPR will serve like a sort of ambulance, easing the economy till the oil price stabilizes.

What you read as US “stockpiles” or “crude inventories” is nothing but SPR. SPR has 90 days worth of oil which can be released during a crisis and allow ambulances and emergency services to still function.

What’s happening right now is where we concentrate. Currently inventories in the US are climbing and climbing up to scale record highs. Analysts predicted a 2.8 million barrel increase but with an increase of 5 million barrels in crude supplies, the stockpile stands at 533.4 million barrels on April 12, a level unseen since the cold war in 1982. There is no shortage of oil and the stock pile continues to rise as the temperature of the world. We have to point out that 533.4 million barrels is a lot of crude even with the present demand and consumption levels.

Alongside domestic production, imports too contributed to the uptick in crude oil inventories. The status quo will remain in spite of Saudi Arabia’s decision to cut exports to the US. Crude exports from the Kingdom to the US are set to fall by at least 300,000 barrels per day. That ought to be bullish as the stockpile would be affected. Yet, the cut in imports would just be seasonal phenomenon as we are confident the exports will pick up by early May. Even if any Gulf country dares stop oil exports to the US, other supply-side competitors will happily fill the gap – more on this later.

At present, the oil market remains volatile. This comes at a time when defense budget is being increased by the Trump administration. A simultaneous increase in military spending and a buildup in strategic petroleum reserve are neither coincidental nor surprising. This follows the current administration’s doctrine of a strong military as a cornerstone of foreign policy.

Oil production increase in the US

A few years back there was a common understanding among oil and gas analysts that if oil prices fell below the $60 mark it would strangulate the shale oil industry. Back then, the break-even price for shale oil production was around $70/barrel. Today, the ground reality has proved to be markedly different. Assuredly, oil production in the US has soared from 8.45 million barrels per day to 9.1 million barrels per day, about the same as what Saudi Arabia produced in February. What happened? Did shale extraction become cheaper in a matter of months? In a way, yes, fracking has become less expensive thanks to automation and innovation. American ingenuity does not simply give up – oil producers have not remained entirely idle during the 2015-2016 period of depressed oil prices. Instead they went back to the drawing board to cut costs and are now back with a vengeance. That’s right, shale producers have learnt to walk the tightrope managing productivity while saving costs.

We are confident in our forecast that domestic oil production is set to climb given current oil prices. Oil production will break the high of the seventies very soon. Indeed, the number of rigs in the US has been a sort of marker for the times to come. The US rig count increased with an addition of 21 rigs, taking the number to 789 rigs, according to Baker Hughes. Coming to the nitty-gritties, oil rig count stood at 631 with an increase of 14 rigs, while the natural gas rig count was at 157 with a rise of six rigs, as on March 17. The rise in rig count is for a 9th straight week. In other words, rig counts have withstood the volatility in oil prices.

Syrian air strikes

The US recently launched cruise missiles against Syrian government bases. Officially, the stated motive was a reaction to the chemical attack on Syrians by President Assad forces. What’s the real story?

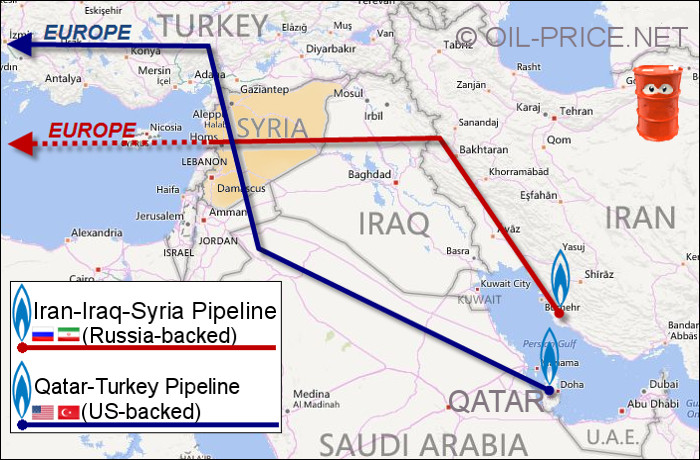

Let’s keep in mind that there is the proposed Qatar-Turkey Pipeline to duct natural gas from Qatar’s South Pars field, the world’s largest Natural Gas Field, to Europe. The plan was jointly supported by Qatar, Saudi Arabia, the US and Europe. Strategically it would have helped Europe avert Russia’s plan to corner its gas supplies. However Qatar’s pipeline would have to transit through Syria. But president Assad, backed by Russia, could not host in Syria a pipeline competing with Russia’s monopoly on European supplies. Assad became a threat to Qatar’s and Saudi Arabia’s European ambitions. And so Gulf states – as they usually do – funneled Islamic fighter into Syria starting in 2014 to overthrow Assad. Thus the bloody Syrian civil war was born.

Figure 1 – Map of proposed Qatar-Turkey and Iran-Iraq-Syria pipelines running through Syria

Meanwhile Russia has been building redundant pipelines into Europe the latest of which (Turkish Stream) positions itself as a replacement of the “Qatar-Turkey” pipeline now on hold. Something had to be done. With energy executive Rex Tillerson now Secretary of State the US, we can reasonably expect Saudi Arabia to receive US military support to overthrow Assad and secure energy routes into Europe. This follows on the footsteps of the US military assistance to Saudi Arabia in Yemen. Thanks to the bombings Saudi Arabia now controls 65% of Yemen’s oil production at a time when new reserves have been discovered in Yemen. Now if only Assad would go, Gulf states would gladly duct all that oil into Europe via Syria.

What about the recent spike in oil prices on the heels of the bombings of Syrian airstrips? Well, Syria is not a major producer of oil and the country is off the oil map for now. To put it bluntly, Syria doesn’t supply any oil to the world, with or without a civil war. What we saw is just short term uncertainty. Fundamentally, the spike is a knee-jerk reaction on the part of investors as there is no reason for supply disruptions.

OPEC cuts fail to impress

Over pas decades OPEC – self-described as a cartel – has managed to manipulate energy prices through orchestrated production cuts under the guise of “maintainging price stability”. However, its loss of relevancy in the world market has accelerated, outpacing all forecasts. How on earth did that happen? Well, OPEC’s control of oil supplies is a thing of the past due to various factors.

Usually, when OPEC wants to increase the price of oil the cartel just asks its member countries to cut down production. As a result, of course, the oil price spikes and everyone associated with OPEC laughs all the way to the bank. Then, finally, the day dawned when OPEC struggled to get 50% compliance from members regarding supply cuts- except Saudi Arabia and Kuwait, that is. Then quietly on the sidelines, Russia, which isn’t a part of OPEC, overtook Saudi Arabia as the world’s number 1 oil producer. OPEC members inner trust irreversibly fell on the wayside.

Now, did the egos fall and crash too? OPEC was aware of losing ground and hastened to cut deals. This year, OPEC and few non- OPEC producers settled to reduce production by 1.8 million barrels per day. In particular, OPEC sitting to bargain with Russia was a sweet sight for sore eyes. We know how hard Russians are at bargaining. What did OPEC give in return? Probably the Moon.

OPEC, to put it kindly, is in dire straits. Ironically, OPEC has only itself to blame. When the shale wave hit the US, OPEC faced serious insecurities. Easier way would have been to eat a pot of ice cream and concentrate on their business. But we are talking about OPEC. Vigorous oil production in the US is OPEC’s worst fear. OPEC planned to carpet bomb the shale oil boom in the US by flooding the world market with cheap oil, causing oil prices to drop to a level impractical for shale producers. Of course, there were reverberations on the US shore. From job cuts to bankruptcies, US saw it all. Oil went below the $30 mark and oil production slowed down too. What OPEC didn’t count on was the rebound and stabilization that happened faster than expected. Many oil companies hibernated through the storm and weatherd it. Others acquired struggling producers and got just bigger and stronger. Also, shale extraction got – relatively – cheaper with advances in automation technology. For the record, drilling has picked up, the rig count has increased and the US is building Keystone XL. So, going forward the US will depend even less on OPEC. Furthermore, crude production in the US is all set to grow by 360,000 bpd in 2017 and increase to 1 million bpd in 2018. That must have dropped a few jaws OPEC-side.

Irreversibly OPEC is losing its hook on how oil prices behave. When it announced production cut for the first six months of 2017, oil would have breached the $80 mark under 2014 market circumstances – but under 2017 market circumstances, oil prices barely reacted.

Unsurprisingly – if not out of sight – the most hurt has been OPEC countries more than western economies. All OPEC nations are in dire need of funds to balance budget and avert the unrest of populations dependent on state welfare fueld by high oil prices. The initial cuts in early 2017 are losing steam and support. Financial markets see that and this is priced in.

As we have explained, crude oil prices now trade as any other commodity, based on supply and demand. For 4 decades OPEC has managed to control the supply and prices but this is now over. OPEC is the proverbial boy who cried wolf and today no-one pays attention any longer.

President Trump makes due on energy promises

For the US to grasp the much sought after freedom from imported oil, it needs to increase domestic oil and gas production even more. The other way is to enable a drastic and sudden increase in oil prices so that the oil companies earn profits and drill more. Still, more production also means more supply and lower prices. Then the oil companies will run on loss and stop drilling, which will ultimately reduce production. Which bring us to the question, which way will, the man of the moment, President Trump go? We know that he is a friend of fossil fuels.

With regard to energy, he had promised to cut taxes and ease environmental regulations so that the US would enjoy an energy boom. Some argue that regulation costs are bit too small for oil companies to make any visible changes. Considering how the previous administration was adamant on cutting drilling on Federal lands with strict policies on fossil fuels, the present administration is a contrast in study. Already, President Trump has signed executive orders paving way for completion of Dakota Access and Keystone XL oil pipeline. Similarly, there are other pipelines that would see the light of the day, thanks to Trump. Thus, much needed infrastructure is coming into place. The job plan of Trump to bolster infrastructure has made a definite start, so. Also, pipelines are more environmentally friendly and safe than truck or shipping than current rail.

US still imports about 7.9 million barrels of crude a day. As you can see, energy independence is still some time away. Far yet so near. And, when the oil boom is unleashed, as Trump has promised, we’ll see another spike in oil and gas drilling. Of course, the rig count and oil production has risen.

Recently the President also signed the Energy Independence executive order that, apart from providing solid support to the coal industry, seeks to undo many of the Obama-era climate change regulations. Goodbye regulation, hello progress. So, the ban on coal leasing on federal lands is gone. Rules governing methane emissions from oil and gas production have been relaxed. The Clean power Plan that requires states to cut carbon emission is out the window too. The immediate implications? Job creation in the coal sector is definitely debatable simply because natural gas is more easily available and is cheaper – in short natural gas has already supplanted coal, is here to stay, and Federal regulation cannot change that.

On course, lower oil prices and energy security.

Gasoline on the horizon

This summer, a robust demand was expected for gasoline because of more drivers on the road. However, the anticipated seasonal spike in gas prices didn’t happen in March. In fact, for the first time since 2009, the average price of gasoline was cheaper than on February 15 when, historically, gasoline prices hit the lowest.

With spring, gasoline prices did increase with the demand. The average price increased by 8 cents gallon compared to March. The present price is the highest since September 2015.

Conclusion

Thanks to fracking, oil production in the US has been soaring. By and by, cost of shale extraction continues to get cheaper. Despite cuts by OPEC and Russia, U.S. oil supplies have grown by leap and bounds. As we mentioned earlier, by 2018 US crude production will hit a million bpd. The recent attack on the airbase in Syria by the US does raise eyebrows as Syria lies just next to Iraq, OPEC’s second largest oil producer. That said, the strike was on a single airbase and Syria role in oil production is nil. So, the spike is shorter. The same goes for Libya’s Sharara oilfield that was shut down for reasons yet unknown. On a world stage, the shutdown isn’t big enough to cause visible changes.

At a time when OPEC is struggling to receive compliance from member countries, the picture of oil in the US is brighter and will remain so for years to come. Even if OPEC extends production cuts beyond June, world crude prices will remain low. Of course, the ‘once upon a time’ powerful cartel fell into the grave it dug for the US. The big question remains, will it creep out?

To sum up: Imports from Canada has risen along with domestic oil production, supply is steady, stockpiles are brimming with oil, drillers are adding rigs, so going forward we forecast oil prices to oscillate in a narrow band.